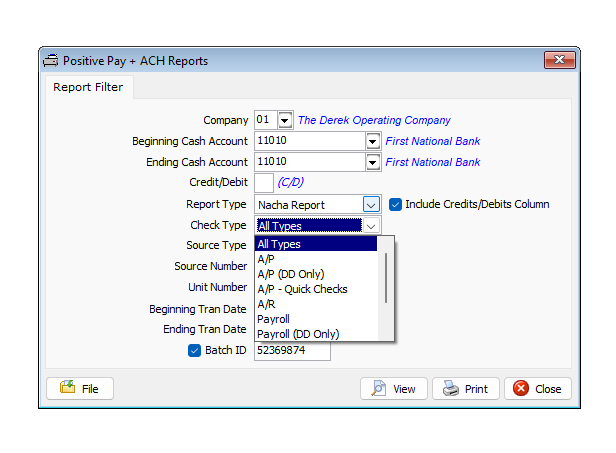

Positive Pay + NACHA Report

We're thrilled to announce a New Add-On program for Positive Pay and NACHA reporting capabilities. This program includes new reports that allow you to view, print, and save in both Excel and PDF formats. You can easily submit these reports to your financial institution or use them with a third-party conversion software.

Don't miss out on our exclusive pre-order opportunity! We're accepting pre-orders until 11/21/2025, and you can enjoy a 25% discount. Secure your item now for just $900 and take advantage of this limited-time offer!

Why is it used?

Fraud Prevention: The main benefit is significantly reducing the risk of check and ACH fraud by ensuring that only authorized payments are processed.

Control: Businesses maintain greater control over which payments are authorized from their account.

Peace of Mind: Implementing Positive Pay can provide business owners with increased security and peace of mind.

How does it work?

A business issues checks or authorizes ACH transactions.

The business generates and sends a Positive Pay file containing the details of these authorized transactions to its financial institution.

When checks are presented for payment or ACH transactions attempt to debit the account, the financial institution compares the details against the Positive Pay file.

If a check or ACH transaction doesn't match the information in the file, it's flagged as an exception.

The business is notified of the exception and can then decide whether to approve or reject the payment.